Accordingly, a moratorium will be announced shortly by the Central Bank to tourism sector institutions and individuals on a case by case basis. The moratorium period will be until 31st March 2020 for both capital and interest payments granted to the tourism sector as of 18th April 2019, a release by the Finance Ministry said.

Furthermore, capital and interest falling due during the moratorium period should be converted into a term loan which should be recovered from July 2020 and charged a concessionary rate.

Enterprise Sri Lanka

With regard to the Enterprise Sri Lanka credit schemes introduced by Finance Minister Mangala Samaraweera to create a new entrepreneur class, the Finance Ministry said that they will allocate Rs. 1.5 billion to provide interim releif for teh tourism sector loans coming under the Enterprise Sri Lanka credit schemes.

Tourism sector loans (Jaya Isura, Green Loan etc.) shall also be considered on a case-by-case basis for the moratorium, State Minister Eran Wickramaratne said. He added that the interest subsidy will be borne by the government on outstanding credit facilities (both capital and interest) granted to the tourism sector in the performing category as at 18th April 2019.

Borrower’s repayment will start from 1st April 2020 and capital and interest payments falling due during the moratorium can be recovered from July 2020 onwards. Alternatively, the repayment period can be extended for the number of months it was falling due during the moratorium.

Tourism loans registered on or before 18th April 2019 will be granted before 31st March 2020 under Enterprise Sri Lanka, with the interest subsidy to be borne by the government to continue from the granted date.

Working Capital Loans

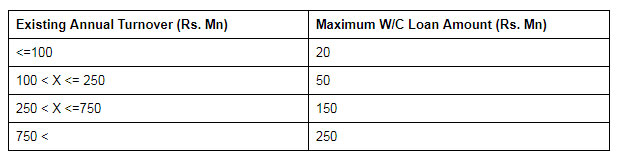

Arrangements have been made to allow the tourism sector to obtain fresh Working Capital under the Enterprise Sri Lanka scheme with a repayment period of 2 years. 75% interest subsidy will be borne by the government from the effective interest rate until 31st March 2020.

The interest will be at 3.4% as the government is giving a 75% interest subsidy, the Finance Ministry said.

VAT Reduced

Concessions for Security Equipment

Finance Minister Mangala Samaraweera, who is on an official visit to Fiji to attend the Annual Meetings of Asian Development Bank (ADB), said on Friday (03) that he was looking to give special concessions to the tourism industry with regard to the importation of security equipment.

Accordingly, the government has allowed the importation of security equipment duty-free, effective from 7th May 2019. However, they will be liable to pay the NBT. The Finance Ministry said that this provision is not limited to the tourism industry and is applicable to all industries. The following security equipment could be imported duty-free.

○ Handheld Metal Detector

○ Walk-through Metal Detector

○ Baggage x-ray Inspection Equipment

○ Vehicle Scanners

0 Comments